The Definitive Guide for Hsmb Advisory Llc

The Definitive Guide for Hsmb Advisory Llc

Blog Article

Indicators on Hsmb Advisory Llc You Should Know

Table of ContentsAll about Hsmb Advisory LlcSome Ideas on Hsmb Advisory Llc You Should KnowSome Known Details About Hsmb Advisory Llc 9 Easy Facts About Hsmb Advisory Llc Shown

Life insurance policy is specifically important if your household is dependent on your income. Sector specialists recommend a plan that pays out 10 times your yearly income. These might consist of home loan repayments, outstanding car loans, credit history card financial debt, tax obligations, youngster care, and future university prices.Bureau of Labor Data, both spouses functioned and brought in earnings in 48. 9% of married-couple families in 2022. This is up from 46. 8% in 2021. They would certainly be most likely to experience monetary hardship as a result of among their wage earners' fatalities. Medical insurance can be acquired with your employer, the federal medical insurance market, or private insurance coverage you acquire for on your own and your family by contacting wellness insurance coverage companies directly or experiencing a health and wellness insurance representative.

2% of the American populace lacked insurance coverage in 2021, the Centers for Illness Control (CDC) reported in its National Facility for Health And Wellness Data. More than 60% got their insurance coverage with a company or in the exclusive insurance coverage industry while the rest were covered by government-subsidized programs consisting of Medicare and Medicaid, experts' benefits programs, and the federal marketplace established under the Affordable Treatment Act.

Hsmb Advisory Llc Things To Know Before You Buy

If your earnings is reduced, you may be one of the 80 million Americans that are eligible for Medicaid.

According to the Social Safety and security Administration, one in 4 employees getting in the workforce will certainly end up being handicapped prior to they get to the age of retired life. While health insurance policy pays for hospitalization and clinical expenses, you are often burdened with all of the expenses that your paycheck had covered.

Several plans pay 40% to 70% of your revenue. The price of disability insurance policy is based on many factors, consisting of age, lifestyle, and health.

Numerous strategies call for a three-month waiting duration prior to the insurance coverage kicks in, give an optimum of 3 years' worth of insurance coverage, and have substantial policy exclusions. Below are your options when buying vehicle insurance: Obligation coverage: Pays for home damages and injuries you create to others if you're at fault for a crash and also covers litigation expenses and judgments or negotiations if you're sued due to the fact that of a car mishap.

Comprehensive insurance coverage covers theft and damages to your car as a result of floods, hail storm, fire, criminal damage, dropping things, and pet strikes. When you finance your vehicle or lease an auto, this type of insurance policy is required. Uninsured/underinsured motorist () protection: If a without insurance or underinsured motorist strikes your automobile, this protection pays for you and your traveler's clinical expenses and may additionally account for lost income or make up for discomfort and suffering.

Company insurance coverage is commonly the most effective option, but if that is not available, obtain quotes from a number of companies as lots of you can try this out offer price cuts if you acquire greater than one kind of coverage. (https://nice-mango-hgdqgs.mystrikingly.com/blog/health-insurance-st-petersburg-fl-tailored-solutions)

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

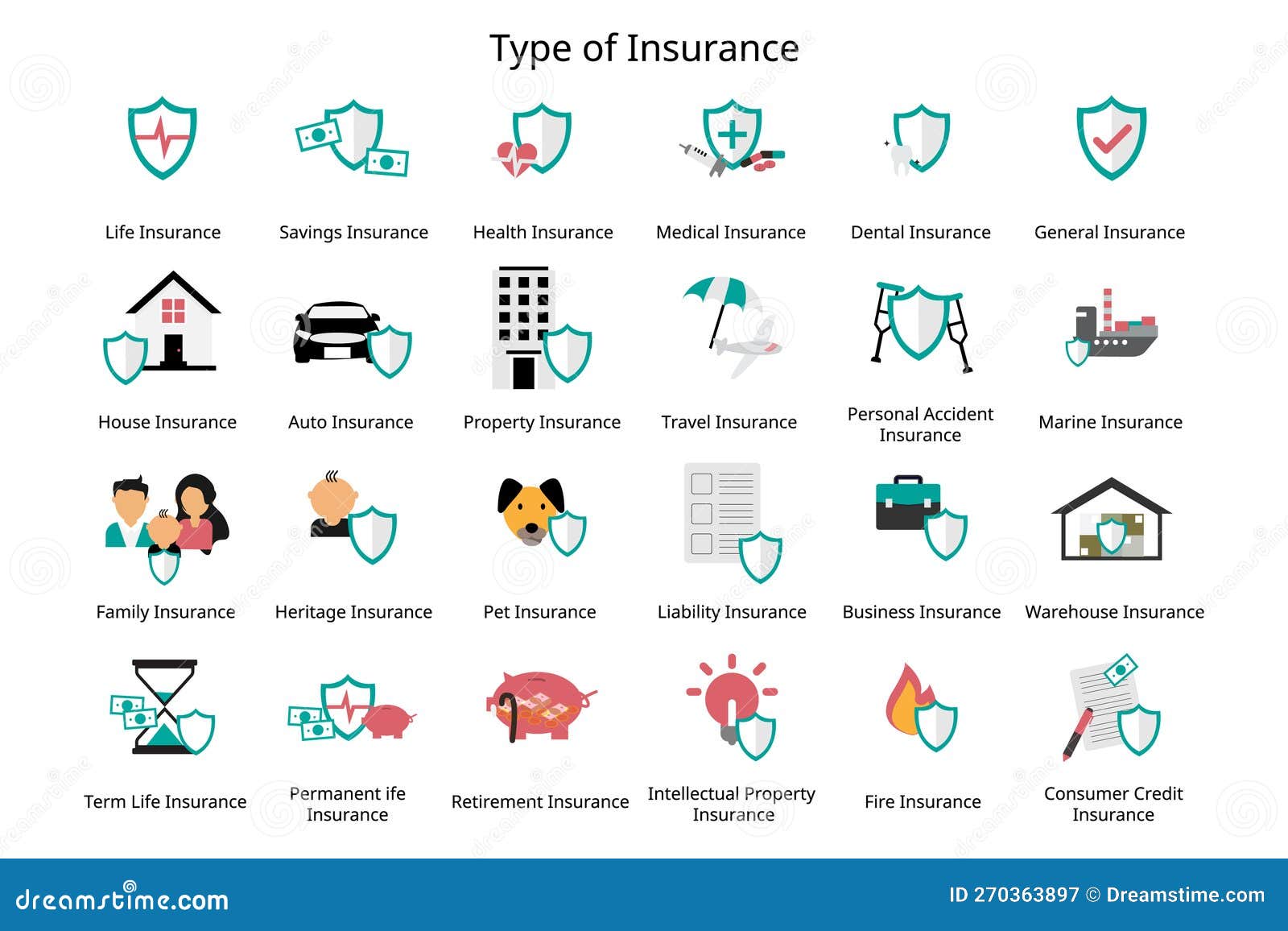

Between medical insurance, life insurance policy, impairment, responsibility, lasting, and also laptop insurance policy, the job of covering yourselfand considering the endless possibilities of what can take place in lifecan feel frustrating. Once you understand the principles and ensure you're effectively covered, insurance policy can increase monetary self-confidence and wellness. Here are the most crucial sorts of insurance coverage you need and what they do, plus a couple tips to avoid overinsuring.

Different states have different guidelines, however you can anticipate health and wellness insurance policy (which several people make it through their employer), automobile insurance coverage (if you possess or drive a vehicle), and house owners insurance policy (if you possess residential property) to be on the list (https://my-store-f53c39.creator-spring.com/). Mandatory types of insurance can change, so check out the current laws every so often, particularly prior to you renew your plans

Report this page